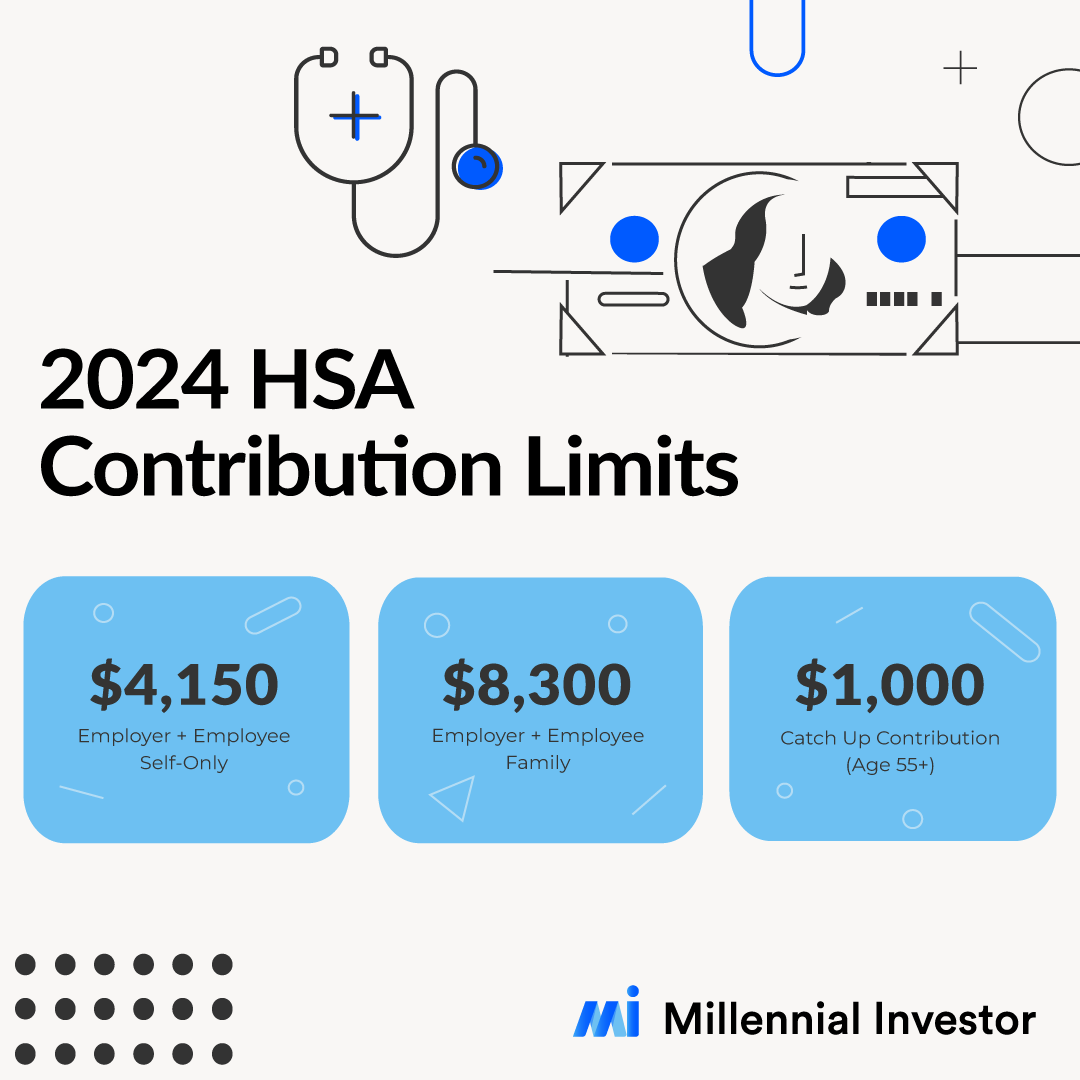

Hsa Contribution Limits 2025 Married - HSA Contribution Limits? College Aftermath, The maximum contribution for family coverage is $8,300. Your contribution limit increases by $1,000 if you’re 55 or older. Hsa Contribution Limits 2025 Married. Those age 55 and older can make an additional $1,000 catch. The maximum contribution for family coverage is $8,300.

HSA Contribution Limits? College Aftermath, The maximum contribution for family coverage is $8,300. Your contribution limit increases by $1,000 if you’re 55 or older.

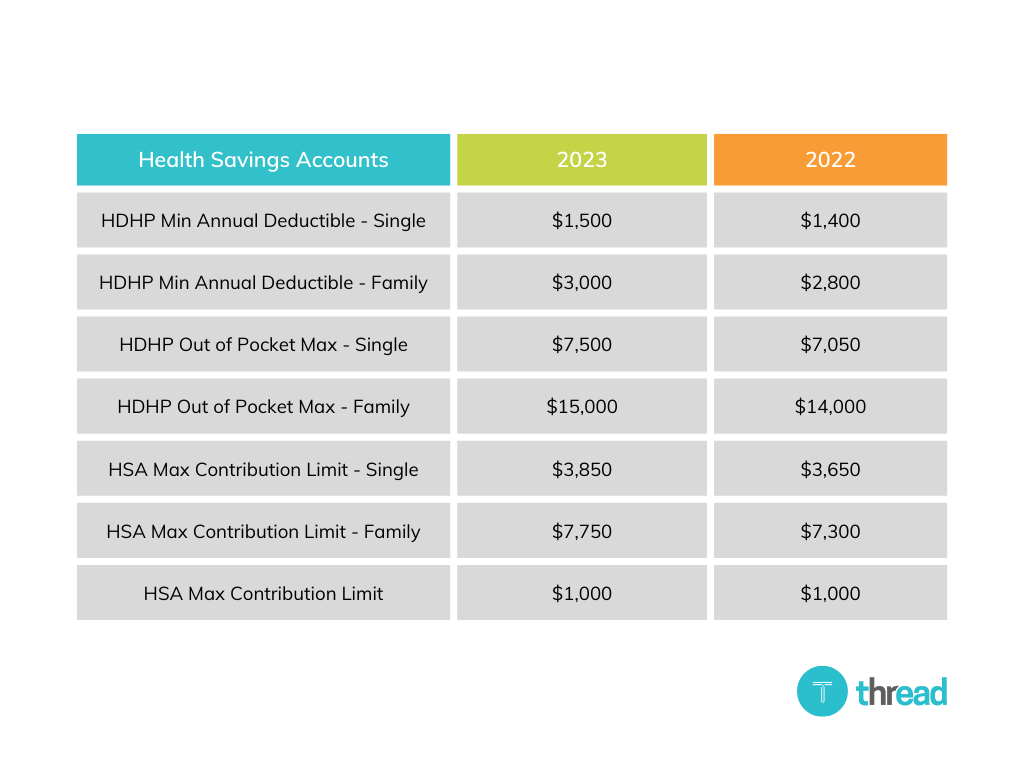

Hsa 2023 Limits 2023, The maximum contribution for family coverage is $8,300. Your contributions to an hsa are limited each year.

Your contribution limit increases by $1,000 if you’re 55 or older.

IRS Announces 2023 HSA Contribution Limits, Employer contributions count toward the annual hsa. For 2025, individuals under a high deductible health plan (hdhp) have an hsa annual contribution limit of $4,150.

HSA Contribution Limits [2023 + 2025], Hsa members can contribute up to the annual maximum amount that is set by the irs. This is a $150 increase for individuals.

12+ Hsa 2023 Contribution Limit Irs For You 2023 GDS, The maximum contribution for family coverage is $8,300. Hsa members can contribute up to the annual maximum amount that is set by the irs.

Maximum contribution limits are based on the calendar year, meaning.

Annual 401k Contribution 2025 gnni harmony, Below are all hsa contributions including your contributions, employer contributions, and maximum annual contribution broken down by coverage. Your contributions to an hsa are limited each year.

Significant HSA Contribution Limit Increase for 2025, Hsa contribution limits for 2025 are $4,150 for singles and $8,300 for families. Below are all hsa contributions including your contributions, employer contributions, and maximum annual contribution broken down by coverage.

Employer contributions count toward the annual hsa. Hsa contribution limits for 2025 are $4,150 for singles and $8,300 for families.

Hdhp Irs Limits 2025 Babs Marian, On may 9, 2025 the internal revenue service announced the hsa contribution limits for 2025. Below are all hsa contributions including your contributions, employer contributions, and maximum annual contribution broken down by coverage.

Annual 401k Contribution 2025 gnni harmony, Employer contributions count toward the annual hsa. For 2025, individuals under a high deductible health plan (hdhp) have an hsa annual contribution limit of $4,150.

Hsa Limits 2025 Include Employer Contributions Gert Nikaniki, On may 9, 2025 the internal revenue service announced the hsa contribution limits for 2025. Your contributions to an hsa are limited each year.

The hsa contribution limit for family coverage is $8,300.